How to Manage Personal Finances Effectively

To manage personal finances effectively, create a budget and track your expenses. Save regularly and prioritize debt repayment.

Managing personal finances can seem daunting, but it doesn’t have to be. Start with a clear budget to understand your income and expenditures. Track every expense to identify spending patterns and areas to cut back. Make saving a habit by setting aside a portion of your income each month.

Prioritize paying off high-interest debts to reduce financial stress. Use tools like budgeting apps or spreadsheets to stay organized. By staying disciplined and informed, you can achieve financial stability and peace of mind. Effective financial management leads to better control over your money and future financial security.

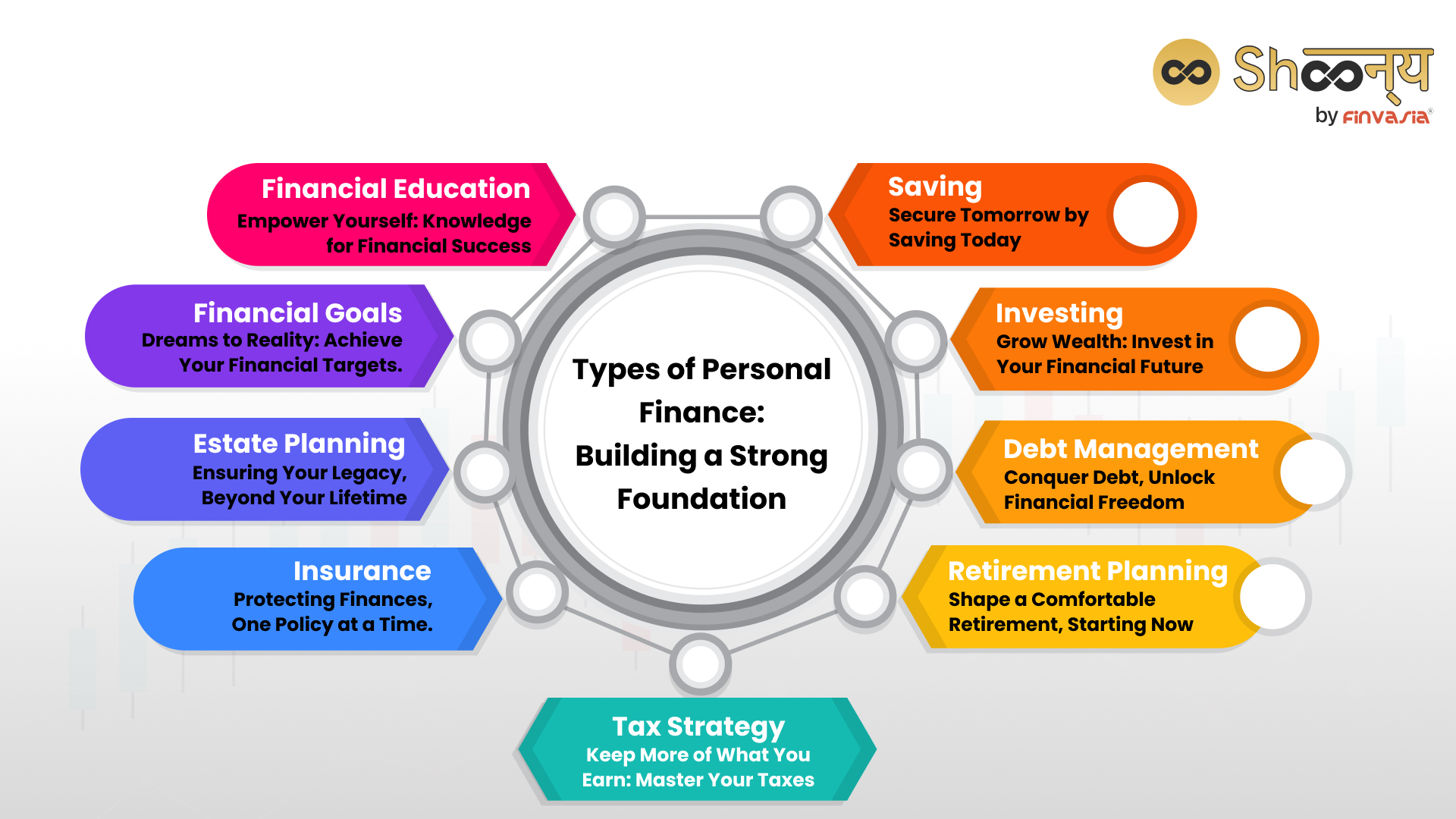

Setting Financial Goals

Setting financial goals is a crucial step in managing your personal finances. It helps you plan for the future and stay on track. Whether short-term or long-term, goals give direction to your financial journey.

Short-term Goals

Short-term goals are those you aim to achieve within a year. These goals are often the stepping stones to bigger financial ambitions.

- Emergency Fund: Save at least $500 for unexpected expenses.

- Debt Repayment: Pay off high-interest credit card debt.

- Monthly Budget: Create and stick to a monthly budget.

Long-term Goals

Long-term goals require more planning and patience. These goals often span over several years.

- Retirement Savings: Aim to save 15% of your income for retirement.

- Home Purchase: Save for a down payment on a house.

- Education Fund: Set aside money for your children’s education.

| Goal Type | Example | Time Frame |

|---|---|---|

| Short-term | Emergency Fund | 6 months |

| Long-term | Retirement Savings | 20 years |

Setting financial goals helps you stay focused and motivated. It ensures you make the most of your money. Start today and watch your financial health improve.

Creating A Budget

Managing your personal finances starts with creating a budget. A budget helps you track income, monitor expenses, and plan for future needs. Let’s break down the process into simple steps.

Income Tracking

First, track all sources of income. This includes your salary, freelance work, and investments. Use a table to list all income sources and amounts:

| Source | Amount |

|---|---|

| Salary | $3,000 |

| Freelance Work | $500 |

| Investments | $200 |

Sum up all income sources. This is your total monthly income. Make sure you update this table each month. Keeping it current is important.

Expense Categorization

Next, categorize your expenses. This helps you see where your money goes. Use a table for clear visualization:

| Category | Amount |

|---|---|

| Rent | $1,000 |

| Groceries | $300 |

| Utilities | $150 |

| Entertainment | $200 |

| Savings | $400 |

Track both fixed and variable expenses. Fixed expenses stay the same each month, like rent. Variable expenses change, like groceries. Use these categories to find areas for saving.

Creating a budget can seem hard. Break it into steps to make it easy. Track your income. Categorize your expenses. This is how you manage personal finances effectively.

Saving Strategies

Effective personal finance management requires smart saving strategies. Below, we’ll explore two crucial elements: an emergency fund and automated savings. These strategies are simple but powerful. Implementing them can significantly improve your financial health.

Emergency Fund

Creating an emergency fund is the first step. This fund covers unexpected expenses. For instance, medical bills or car repairs. Start by saving a small amount each month. Even $20 can make a difference. Gradually, aim to save enough to cover three to six months of expenses.

Here’s a simple table to help you start:

| Monthly Savings | Annual Savings |

|---|---|

| $20 | $240 |

| $50 | $600 |

| $100 | $1200 |

Keep this fund in a separate account. This prevents spending it on non-emergencies. An emergency fund provides peace of mind. It ensures you are prepared for unexpected events.

Automated Savings

Automated savings make saving effortless. Set up automatic transfers from your checking account. Choose a specific amount and date. This ensures you save consistently.

Follow these simple steps to automate your savings:

- Log in to your bank account.

- Select ‘Transfers’ or ‘Automated Transfers’.

- Choose your savings account as the destination.

- Set the amount and frequency (weekly, bi-weekly, or monthly).

- Confirm the transfer settings.

Automated savings help you stick to your savings goals. You won’t forget to save. This method also reduces the temptation to spend. Over time, you’ll build a significant savings buffer effortlessly.

Incorporating these saving strategies can transform your financial situation. Start with small steps. Over time, the results will show.

Credit: www.wealthandfinance-news.com

Managing Debt

Managing debt is crucial for effective personal finance. It helps you stay financially healthy and stress-free. This section provides key strategies to manage debt effectively.

Debt Repayment Plans

Creating a debt repayment plan is the first step. It helps you see the bigger picture. There are several methods to consider:

- Debt Snowball Method: Pay off the smallest debt first. Then move to the next smallest.

- Debt Avalanche Method: Focus on paying off debts with the highest interest rate first.

- Debt Consolidation: Combine multiple debts into one with a lower interest rate.

Choose the method that works best for your situation. Stick to the plan for the best results.

Credit Score Improvement

Improving your credit score is essential. It can help you get better interest rates. Here are some tips:

- Pay your bills on time. Late payments hurt your score.

- Keep your credit card balances low. High balances can lower your score.

- Don’t open too many new accounts at once. It can look risky to lenders.

- Check your credit report regularly. Fix any errors you find.

Following these tips can help improve your credit score over time.

Investing Wisely

Investing is a key aspect of managing personal finances effectively. It helps grow your wealth over time. Smart investments can secure your financial future. This section covers investment options and risk management.

Investment Options

Choosing the right investment options is crucial. Here are some popular choices:

- Stocks: Buying shares in companies. High risk but high reward.

- Bonds: Loans to companies or governments. Lower risk than stocks.

- Mutual Funds: Pool of funds from many investors. Managed by professionals.

- Real Estate: Investing in property. Can provide rental income.

- Index Funds: Tracks a market index. Diversifies risk.

Risk Management

Managing risk is essential in investing. Different investments have different risk levels. Here are some strategies:

- Diversification: Spread your investments across different assets. Reduces risk.

- Asset Allocation: Mix of different asset classes. Balances risk and reward.

- Regular Monitoring: Keep an eye on your investments. Adjust as needed.

- Emergency Fund: Have a cash reserve. Covers unexpected expenses.

Here is a simple table showing the risk level of different investments:

| Investment | Risk Level |

|---|---|

| Stocks | High |

| Bonds | Low |

| Mutual Funds | Medium |

| Real Estate | Medium |

| Index Funds | Low |

Credit: www.talk-business.co.uk

Tracking Spending

Managing personal finances starts with understanding where your money goes. Tracking spending helps you see your financial patterns. It guides you to make better choices. Let’s dive into how to track your spending daily and monthly.

Daily Tracking

Daily tracking keeps you aware of your spending habits. It helps you catch unnecessary expenses quickly. Here are some methods for daily tracking:

- Use a notebook: Write down every purchase you make.

- Apps: Use budgeting apps like Mint or YNAB.

- Receipts: Save receipts and review them each day.

Consistency is key. Make tracking a part of your daily routine. This way, you stay on top of your finances.

Monthly Reviews

Monthly reviews give a big-picture view of your spending. They help you see trends over time. Here’s how to conduct a monthly review:

- Gather all your daily tracking data.

- Sort expenses into categories (e.g., groceries, entertainment).

- Use a spreadsheet to total each category.

Consider using a table for clarity:

| Category | Amount Spent |

|---|---|

| Groceries | $300 |

| Entertainment | $150 |

| Transport | $100 |

Reviewing monthly helps you adjust your budget. It shows where you can cut costs. It also highlights areas where you might need to spend more.

Planning For Retirement

Planning for retirement is a crucial part of managing your personal finances. Proper planning ensures you have enough funds to live comfortably after you stop working. Starting early can make a significant difference in achieving your retirement goals.

Retirement Accounts

Various retirement accounts can help you save effectively. Understanding these options is key to making informed decisions.

- 401(k) Plans: Employer-sponsored plans with potential matching contributions.

- IRAs (Individual Retirement Accounts): Personal accounts with tax advantages.

- Roth IRAs: Contributions are taxed, but withdrawals are tax-free.

Contribution Strategies

Effective contribution strategies can maximize your retirement savings.

- Start Early: Begin saving as soon as possible to benefit from compound interest.

- Employer Matching: Always contribute enough to get the full employer match.

- Increase Contributions: Gradually increase your contributions over time.

- Automate Savings: Set up automatic contributions to ensure consistent saving.

| Account Type | Contribution Limit (2023) | Tax Advantages |

|---|---|---|

| 401(k) | $20,500 | Pre-tax contributions reduce taxable income. |

| IRA | $6,000 | Contributions may be tax-deductible. |

| Roth IRA | $6,000 | Tax-free withdrawals in retirement. |

Financial Literacy

Financial Literacy is the foundation of managing personal finances effectively. It involves understanding basic financial concepts, like budgeting, saving, investing, and debt management. Improving your financial literacy can help you make informed decisions and build a secure financial future.

Educational Resources

There are many educational resources available to boost your financial knowledge. These resources come in various formats, making learning accessible and engaging.

- Books: Many books cover different aspects of personal finance. Popular titles include “Rich Dad Poor Dad” and “The Total Money Makeover”.

- Online Courses: Websites like Coursera and Udemy offer courses on financial literacy. These courses can be completed at your own pace.

- Webinars: Financial experts often host free webinars. These events provide valuable tips and strategies.

- Podcasts: Listening to finance-related podcasts can be a great way to learn on the go. Some popular podcasts include “The Dave Ramsey Show” and “Planet Money”.

Financial Advisors

Financial advisors can offer personalized guidance. They help you create a financial plan tailored to your needs.

| Type of Advisor | Services Provided |

|---|---|

| Certified Financial Planner (CFP) | Comprehensive financial planning, including retirement and estate planning. |

| Investment Advisor | Advice on investment strategies and portfolio management. |

| Tax Advisor | Guidance on tax planning and preparation. |

Choosing the right advisor depends on your specific needs. Look for professionals with relevant certifications and experience.

Improving your financial literacy is a crucial step. Use educational resources and seek advice from financial advisors. This will help you manage your personal finances effectively.

Credit: fastercapital.com

Conclusion

Mastering personal finances requires discipline and smart strategies. Implement budgeting, saving, and investing practices. Monitor expenses regularly and adjust as needed. Stay informed about financial trends and seek professional advice when necessary. By following these steps, you can achieve financial stability and peace of mind.

Start managing your finances effectively today!