The Importance of Financial Literacy

Financial literacy is crucial for making informed financial decisions and securing financial stability. It empowers individuals to manage money effectively.

Understanding financial literacy helps you control your finances and plan for the future. It involves knowledge of budgeting, saving, investing, and debt management. Financially literate individuals can make informed decisions, avoid excessive debt, and build wealth over time. This literacy is essential in today’s complex financial environment, where poor financial decisions can have long-term negative impacts.

By learning financial principles, you gain the skills to navigate economic challenges and achieve financial goals. Investing time in financial education yields lifelong benefits, ensuring you are prepared for financial emergencies and can capitalize on investment opportunities.

Financial Literacy Basics

Financial literacy is essential for everyone. Understanding financial basics helps in making informed decisions. This section explores the key concepts and why financial literacy matters.

Key Concepts

Financial literacy involves understanding several key concepts:

- Budgeting: Planning income and expenses effectively.

- Savings: Setting aside money for future needs.

- Investing: Growing money through various investment options.

- Credit: Managing borrowed money wisely.

- Debt: Understanding and controlling owed money.

Why It Matters

Financial literacy is crucial for several reasons:

- Reduces Financial Stress: Knowing how to manage money reduces anxiety.

- Improves Decision-Making: Informed choices lead to better financial health.

- Prepares for Emergencies: Savings and planning protect against unexpected expenses.

- Supports Long-Term Goals: Investing and saving help achieve future aspirations.

Understanding these basics ensures a stable and secure financial future.

Credit: www.teachhub.com

Personal Finance Management

Understanding personal finance management is crucial for financial stability. It helps you control your expenses and save for the future. Learn how to manage your money effectively.

Budgeting Tips

Creating a budget is the first step in personal finance management. Follow these tips to make a solid budget:

- Track your expenses: Write down every expense for a month.

- Set realistic goals: Know what you want to achieve financially.

- Divide income: Allocate your income into needs, wants, and savings.

- Use budgeting apps: Apps can help you track spending easily.

Saving Strategies

Saving money ensures you are prepared for unexpected expenses. Use these strategies to save effectively:

- Automate savings: Set up automatic transfers to your savings account.

- Create an emergency fund: Save money for unforeseen expenses.

- Avoid unnecessary purchases: Think twice before buying non-essentials.

- Take advantage of sales: Buy items on sale to save money.

By following these budgeting tips and saving strategies, you can manage your finances better. Stay disciplined and watch your savings grow.

Debt And Credit

Understanding Debt and Credit is crucial for financial literacy. They impact your financial health and future. Knowing how to manage debt and maintain a good credit score can save you money and stress.

Types Of Debt

Debt comes in many forms. Here are the main types:

- Credit Card Debt: This is the most common type. It has high interest rates.

- Student Loans: Loans taken to pay for education. These often have lower interest rates.

- Mortgages: Loans used to buy a home. These usually have lower interest rates.

- Auto Loans: Loans for purchasing a vehicle. These can vary in interest rates.

- Personal Loans: Unsecured loans for various purposes. These have higher interest rates.

Credit Scores

A Credit Score is a numerical representation of your creditworthiness. It ranges from 300 to 850. A higher score means better credit.

Factors affecting your credit score:

- Payment History: Timely payments improve your score.

- Credit Utilization: Using less of your available credit boosts your score.

- Length of Credit History: Older accounts improve your score.

- New Credit: Too many new accounts can lower your score.

- Credit Mix: A variety of credit types can help your score.

Here is a table summarizing credit score ranges:

| Credit Score Range | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

Credit: www.forbes.com

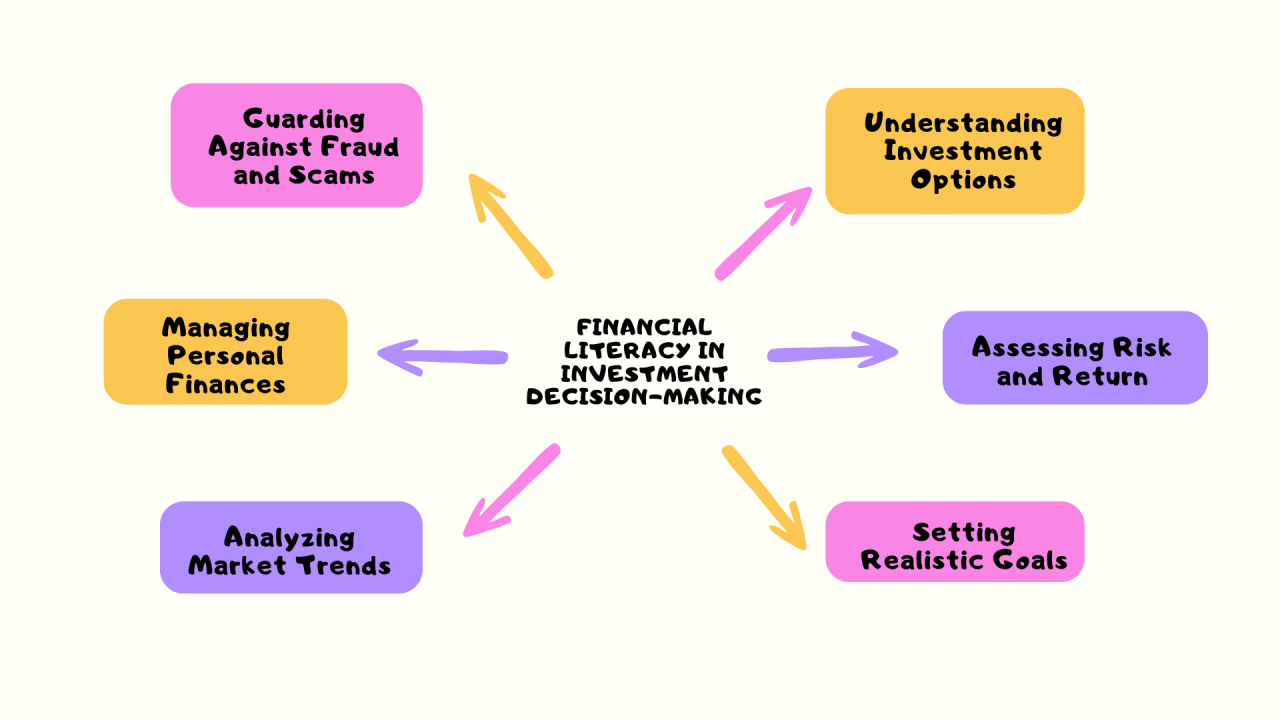

Investing Essentials

Financial literacy is very important in today’s world. Knowing how to invest your money can lead to a better future. This section covers the basics of investing. Investing essentials include understanding different options and managing risks.

Investment Options

There are many ways to invest your money. Each option has its own benefits and risks. Here are some common investment options:

| Investment Type | Benefits | Risks |

|---|---|---|

| Stocks | High return potential | Market volatility |

| Bonds | Stable income | Lower returns |

| Real Estate | Property value appreciation | High initial cost |

| Mutual Funds | Diversified portfolio | Management fees |

Risk Management

Managing risks is key to successful investing. Here are some tips to help you manage risks:

- Diversify your investments.

- Invest in different types of assets.

- Research before investing.

- Monitor your investments regularly.

- Seek professional advice if needed.

Proper risk management can help protect your investments. This ensures a better financial future.

Retirement Planning

Planning for retirement is crucial for a secure future. Financial literacy plays a key role in this process. Understanding how to manage and grow your finances ensures a comfortable and stress-free retirement. Let’s explore the importance of retirement accounts and setting long-term goals.

Retirement Accounts

Retirement accounts are essential for building a nest egg. They help you save and invest your money wisely. Common types include:

- 401(k) Plans: Offered by employers, these plans often include matching contributions.

- Individual Retirement Accounts (IRAs): These are personal accounts with tax advantages.

- Roth IRAs: Contributions are taxed, but withdrawals in retirement are tax-free.

Understanding these accounts helps you make informed decisions. It ensures your money grows over time. Many plans offer tax benefits, which can enhance your savings. You should regularly review your accounts to maximize your retirement funds.

Long-term Goals

Setting long-term goals is vital for retirement planning. Clear goals guide your saving and investment strategies. Consider these steps:

- Determine Your Retirement Age: Decide when you want to retire.

- Estimate Your Expenses: Calculate your future living costs.

- Set Savings Targets: Figure out how much you need to save each year.

- Invest Wisely: Choose investments that match your risk tolerance.

Writing down your goals makes them more achievable. Regularly review and adjust your goals as needed. This ensures you stay on track for a comfortable retirement.

Financial literacy empowers you to plan effectively. It helps you secure your future and enjoy your golden years.

Financial Scams

Financial scams are a growing threat in today’s digital world. Scammers use various techniques to deceive and steal from people. Understanding these scams is crucial to protect your hard-earned money.

Common Scams

Scammers often use different methods to trick their victims. Here are some common scams:

- Phishing: Fake emails or messages asking for personal information.

- Investment Fraud: Promises of high returns with no risk.

- Lottery Scams: Notifications claiming you won a prize you never entered.

- Identity Theft: Stealing personal details to access your accounts.

- Tech Support Scams: Fake calls claiming your device has a virus.

How To Protect Yourself

Protecting yourself from financial scams requires vigilance and knowledge. Here are some tips:

- Verify Sources: Always check the authenticity of emails and messages.

- Use Strong Passwords: Create complex passwords and update them regularly.

- Monitor Accounts: Regularly check your bank and credit card statements.

- Educate Yourself: Learn about common scams and how they work.

- Report Suspicious Activity: Inform authorities if you suspect fraud.

By understanding common scams and taking proactive steps, you can safeguard your finances. Stay informed and alert to protect yourself from fraudsters.

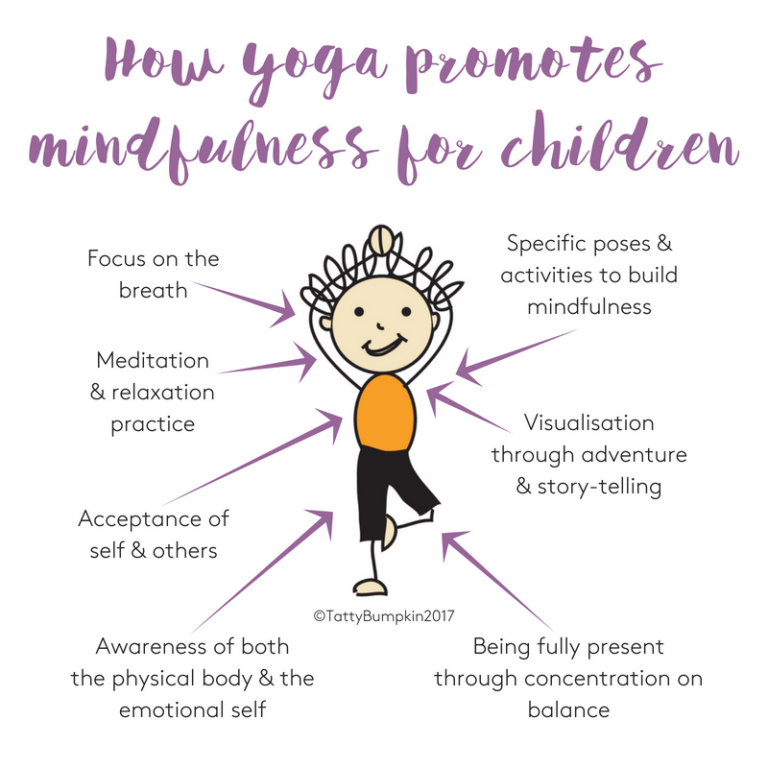

Financial Literacy In Education

Financial literacy is essential for everyone. Teaching it early helps kids make smart money choices. Schools and online resources play a big role in this.

School Programs

Many schools now include financial literacy in their curriculum. These programs teach kids about savings, budgeting, and investments. Interactive lessons make learning fun and easy. Students learn through games, projects, and real-life scenarios. Schools often invite financial experts to speak. This helps kids understand the real-world importance of money management.

| Grade Level | Topics Covered |

|---|---|

| Elementary | Basic savings, Needs vs. Wants |

| Middle School | Budgeting, Simple interest |

| High School | Investing, Credit management |

Online Resources

Online resources offer great ways to learn financial literacy. Websites and apps provide interactive tools and tutorials. Kids can learn at their own pace. Many platforms offer free courses on budgeting, saving, and investing. YouTube channels also provide educational videos. These resources are accessible anytime, making learning flexible and convenient.

- Khan Academy: Offers free courses on financial basics

- Mint: Budgeting app with educational resources

- Investopedia: Articles and tutorials on investing

Global Perspectives

Financial literacy is crucial in today’s interconnected world. Understanding global perspectives on financial literacy helps us see the bigger picture. Different countries approach financial education in unique ways.

Financial Literacy Around The World

Financial literacy varies widely across the globe. Some countries excel in financial education, while others struggle.

In Nordic countries, financial literacy is high. Schools include money management in their curriculum early on. This ensures children grow up with a strong financial foundation.

In the United States, financial literacy is improving but still has gaps. Many adults lack basic financial skills. Schools and organizations are working to change this.

In developing countries, financial literacy is often low. Limited access to education and resources contributes to this issue. Organizations are stepping in to provide financial education.

International Best Practices

Countries with high financial literacy rates share some best practices. These strategies can be adopted globally to improve financial education.

- Early Education: Introducing financial concepts in early education.

- Practical Learning: Using real-life examples to teach money management.

- Accessible Resources: Providing free and easy-to-understand materials.

- Continuous Learning: Encouraging lifelong financial education.

Below is a table comparing financial literacy initiatives in different countries:

| Country | Initiatives | Impact |

|---|---|---|

| Finland | Mandatory financial education in schools | High financial literacy rates |

| Australia | Government-funded financial workshops | Improved financial awareness |

| India | Non-profit financial literacy programs | Increased financial inclusion |

Credit: www.linkedin.com

Conclusion

Financial literacy empowers individuals to make informed decisions. It promotes better management of personal finances. Building financial skills can lead to a more secure future. Understanding money matters reduces stress and increases confidence. Prioritize financial education to enhance your life and achieve your financial goals.